Following the TCFD Recommendations

The Task Force on Climate-related Financial Disclosures (TCFD) was formed by the Financial Stability Board at the request of the Group of 20 and recommended that listed companies identify and disclose climate-related risks and opportunities. In Japan, the revised Corporate Governance Code was published in June 2021, requiring companies listed on the Prime Market to follow the TCFD recommendations.

Issues related to the current global climate change crisis are among the material management issues our business must face head-on with an eye to sustainability. We have developed an internal system that includes a company-wide organizational body for appropriately addressing these issues as well as a management mechanism designed to accurately identify the risks and opportunities associated with these issues and systematically resolve them.

We will analyze strategies and responses to the impact of climate-related risks and opportunities on our operations and finances in light of the characteristics of our operations, their scale, value chains, etc., and consider setting activity targets and indicators in the future.

Governance

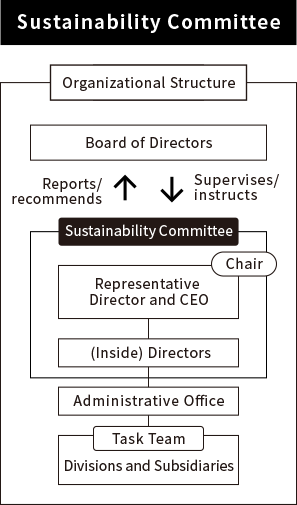

We have established a sustainability committee under the Board of Directors in order to study and address various medium- to long-term issues related to our operations.

The committee consists entirely of directors and is chaired by the representative director and CEO. The chair will invite non-members to attend Sustainability Committee meetings and seek advice from outside experts, etc. as needed.

The Sustainability Committee is responsible for formulating basic sustainability policies, developing mechanisms, looking into actions to take, and setting targets and indicators for the Morito Group as a whole with a focus on environmental, social, and governance (management) factors, including climate change issues. The committee also conducts status surveys within the group. Initiatives discussed by the committee are subject to oversight and direction by the Board of Directors.

Strategies

Since we are primarily a trading company, climate change due to global warming is likely to have multiple effects on our group’s operations, such as a hike in the cost of procuring materials and products and supply chain disruptions caused by natural disasters.

We evaluate these potential impacts through scenario analysis and consider countermeasures to address the risks and opportunities.

1. Scenario analysis

In identifying the risks and opportunities that climate change poses to our group and drawing up medium- to long-term strategies for these risks and opportunities, we use the following internationally recognized climate change scenarios as a reference for the period up to 2030. These scenarios are based on the assumptions that the global average temperature by 2100 will either increase by less than 1.5°C or rise 4°C.

The scenario for keeping global warming below 1.5°C is substituted with a scenario for keeping global warming below 2.0°C when it’s not available.

1. Period covered

Up to 2030

Reference scenario: Net Zero Emissions by 2050 Scenario (NZE)

[Alternate scenario: Sustainable Development Scenario (SDS)]

Published by International Energy Agency (IEA)

Reference scenario: Representative Concentration Pathways (RCP 8.5)

Published by Intergovernmental Panel on Climate Change (IPCC)

| Category | Opportunities/risks | Time frame* | Severity of impact | Description | Major initiatives/response policy | ||

|---|---|---|---|---|---|---|---|

| 1.5℃ | 4℃ | ||||||

| Transition risk | Laws and regulations | Opportunities | Long term | Low | Low | ・ Emergence of demand for new products associated with the use of new materials that are not subject to regulations |

・ Strengthen sales of products made using less energy or with renewable energy |

| Risks | Long term | High | Low | ・ Increase in business costs due to the introduction of policies to reduce greenhouse gas emissions (carbon tax, etc.) ・ Increased costs due to restrictions on product materials |

・ Work toward carbon neutrality ・ Promote a shift to next-generation materials |

||

| Market | Opportunities | Medium term | Low | Low | ・ Emergence of demand for sustainable products in response to environmental changes ・ Promoting the development of functional materials ・ Increased preference for and value placed on environmentally friendly products |

・ Develop and use materials designed to reduce environmental impact ・ Expand line of eco-friendly products and share information with an eye to promoting sustainability |

|

| Risks | Medium term | High | Low | ・ Increased costs due to higher fuel prices for transportation, etc. ・ Decrease in the demand for current products ・ Rising costs due to the need for alternative manufacturing methods |

・ Build an efficient distribution system ・ Promote a shift to products using next-generation materials |

||

| Physical risks | Urgent | Opportunities | Medium term | Low | Low | ・ Increasing demand for functional products that withstand inclement and extreme weather conditions |

・ Develop and sell new products with improved functionality for risk management |

| Risks | Long term | Low | Low | ・ Costs incurred due to damage to business locations and disruption of supply routes caused by extreme weather ・ Rising costs due to increased energy use for temperature control associated with higher/lower temperatures |

・ Strengthen flood control measures and management of company assets through BCP ・ Implement comprehensive supply chain risk management |

||

*Time frame before risks and opportunities are materialized

(Short term: up to 3 years, Medium term: 3 to 7 years, Long term: 7 years or more)

2. Financial impact assessment

In the scenario analysis, we have examined and analyzed climate-related risk factors that are expected to affect our group in the future.

In fiscal 2022, we assessed the financial impact on our apparel business, the bedrock business upon which we were founded, covering all domestic and overseas group companies (excluding subsidiaries that are subject to only minor impacts). We plan to expand the analysis to other business areas in the future.

<1.5°C scenario>

We examined the introduction of a carbon tax due to the full-scale implementation of greenhouse gas control policies.

Using the IEA’s NZE scenario and assuming that a carbon tax will be introduced in the countries where we operate, we assessed the financial impact based on our current GHG emissions (scopes 1 and 2). In light of the assessment results, we believe that the financial impact will be minimal.

In addition, since we are primarily a trading company, we believe that the financial impact of increased fuel prices, including electricity prices, will be minimal and that we are resilient to climate-related risks.

<4°C scenario>

In this scenario where the introduction of measures for decarbonization is gradual, we estimated the resulting impact of possible damage from floods and storm surges caused by intensifying weather-related disasters.

Due to the nature of our business as a trading company, we have limited business assets, and we do not expect a significant financial impact on our company.

We are making ongoing efforts to enhance our BCP in light of disaster risks and are strengthening supply chain management in order to minimize the possibility of damage.

We also believe that swift and flexible business operations, such as those where we have switched gears to focus on developing functional products that can withstand extreme weather conditions, will enable us to expand our business horizons.

Risk Management

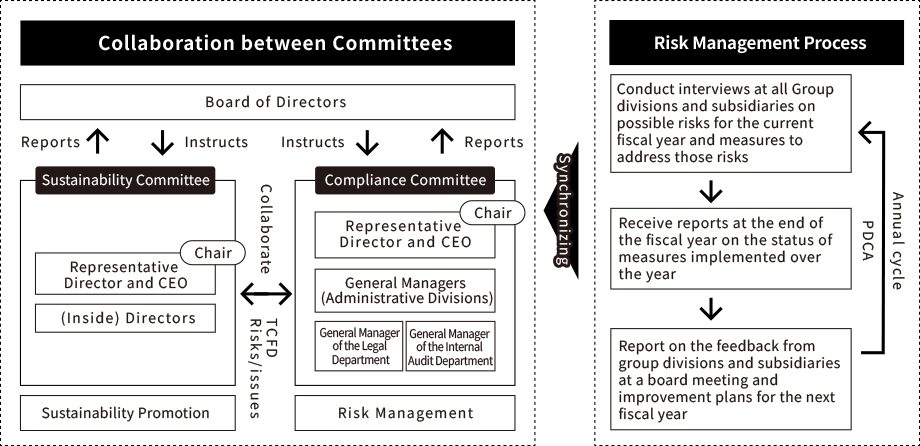

The risk management system we have put in place covers all business activities across the Group. We have also established a compliance committee to oversee risk management. The committee is chaired by the representative director and CEO and consists of the general managers of administrative divisions, the general manager of the Legal Department, and the general manager of the Internal Audit Department.

The Compliance Committee uses a PDCA cycle to manage risks. It assesses company-wide risks through annual interviews conducted at all divisions and subsidiaries. The committee references that assessment in conducting analysis that uses a risk matrix for the probability of the risk’s occurrence and its impact. It reports to the Board of Directors twice a year on the results of the measures taken against the risks identified and evaluated as well as improvement plans.

This management cycle is synchronized and coordinated with the activities of the Sustainability Committee. The Compliance and Sustainability Committees share information and work together to identify risks related to climate change. The Sustainability Committee is responsible for formulating policies and strategies as well as monitoring initiatives to enhance corporate value by minimizing risks and maximizing opportunities related to climate change.

Indicators and Targets

In fiscal 2022, we began measuring CO₂emissions from our operations worldwide in accordance with the GHG Protocol, an international standard, in order to reduce greenhouse gas emissions.

| Area | Scope1 | Scope2 | Total |

|---|---|---|---|

| Japan | 667 | 917 | 1,584 |

| Overseas | 1,752 | 4,166 | 5,918 |

● In fiscal 2022, we began calculating scope 1 and scope 2 greenhouse gas (GHG) emissions at our group companies in Japan and overseas.

We recognize that it is our social responsibility to ultimately achieve carbon neutrality across our entire supply chain and will build a system to reduce scope 3 emissions as well.

● At present, we have not set GHG emission reduction targets, but as soon as we identify the sources of emissions and other details, we will monitor emissions and make reduction efforts on an ongoing basis.

We will continue to actively work toward realizing a sustainable society to meet the Japanese government’s challenge of becoming carbon neutral by 2050.

*What are the scopes?

Scope 1: Direct greenhouse gas emission from resources owned and controlled by an organization

Scope 2: Indirect emissions associated with purchased electricity, heat, and steam used by the organization

Scope 3: Indirect emissions other than scope 1 and scope 2 emissions (emissions from activities of other companies that are related to the organization’s activities)